If you have insurance policy but can not confirm it when you get drawn over or at the scene of an accident, you are guilty of an "administrative infraction," similar to a seat-belt ticket. Your citation will not be rejected even if you can offer the court with evidence of legitimate insurance policy for the date of the citation. credit.

Driving without cars and truck insurance coverage at all is far more serious, and also the charges are more severe. Along with the legal consequences, you can also anticipate your cars and truck insurance costs to increase. A single sentence for driving without insurance raises yearly costs by an average of 36%, or $647, in The golden state (credit score).

Driving without insurance can make it difficult to be made up for problems if you are not to blame and can have long-lasting credit score and also life-altering repercussions if you are at fault. If the accident is your fault, you'll have to pay for all the damages out of your own pocket. In enhancement to the lawful repercussions for driving without insurance, you might conveniently be responsible for tens of thousands of dollars or even more in damages to your vehicle, the other vehicle driver's repair service as well as healthcare facility costs, as well as your very own treatment.

insurance company credit score cheaper auto insurance dui

insurance company credit score cheaper auto insurance dui

Also if the crash is not your fault, driving without insurance coverage leaves you at risk to pricey health center and also repair work costs. In at-fault states, the various other chauffeur is usually liable for damage to your cars and truck as well as any medical treatment you may needassuming the various other motorist is found entirely at-fault.

accident cheap car insurance vehicle cheap

accident cheap car insurance vehicle cheap

affordable insurance affordable car insurance accident

affordable insurance affordable car insurance accident

Driving without insurance doesn't negate the other motorist's mistake totally, however you're likely going to be penalized and also unable to recoup everything you would certainly be entitled to if you had insurance. You can get automobile insurance policy in California, also if you are Unless you're a recently accredited motorist, having a background of driving without insurance or gaps in insurance coverage is a risk to insurance providers.

Some Ideas on California Car Insurance - Usaa You Need To Know

USAA, State Ranch, Nationwide, and also Geico tend to have the least expensive rates for motorists that wish to reclaim protection. It's not illegal to drive another person's car if you do not have insurance coverage, yet non-owner cars and truck insurance can protect you if you do not have a vehicle yet still drive on a regular basis (business insurance).

In The golden state, motorists with simply two speeding tickets pay an average of 97% even more on their annual automobile insurance premiums, as an example. Relying on your driving record as well as the severity of your violations, you might pay a lot more. Still, despite the fact that rates might be higher, at the very least you can drive legally and also avoid more fines - insurance affordable.

The effects of driving without insurance are inevitably more costly than purchasing minimum automobile insurance policy coverage - cheaper car insurance. No issue what your unique requirements are, the very best means to obtain exact quotes and the most effective prices is to comparison store. liability.

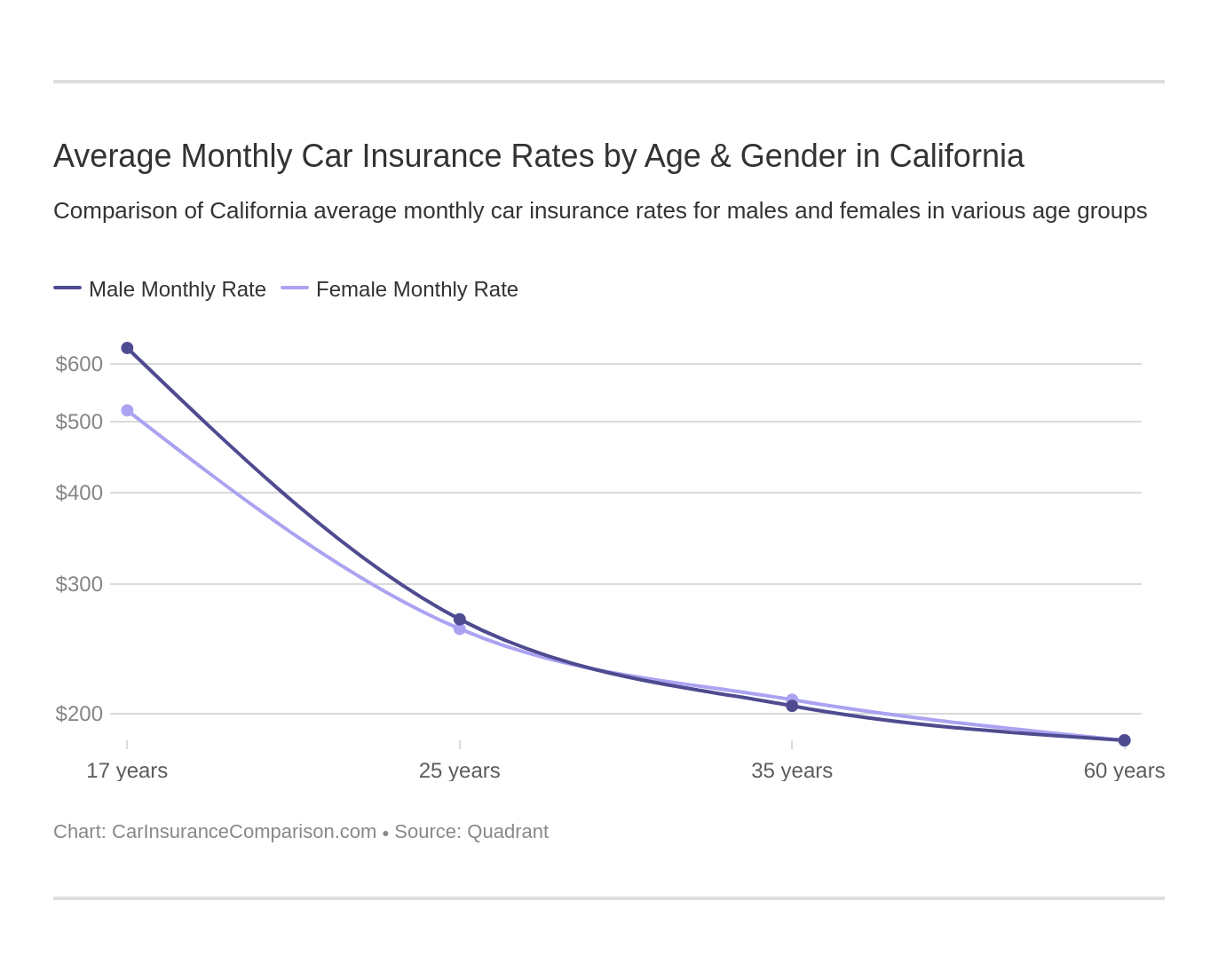

To aid you understand just how prices vary, Money, Geek broke down California's ordinary price according to the elements most impacting it - car. Average Price of Cars And Truck Insurance Policy in California: Recap, There are many factors affecting vehicle insurance rates in The golden state. Age is the factor that influences premium rates the most, complied with by how much protection you acquire - cheaper car insurance.

, putting the state in 10th area. Both contribute to the high chance of chauffeurs filing claims. insured car. A 16-year-old would be much better off being added to their parents' automobile insurance coverage plan than buying one on their very own (car).

Exactly How Much Is Automobile Insurance Policy in Your City? The cost of vehicle insurance policy differs from state to state.

In Santa Maria, premiums cost an average of $1,109 each year, 22 (cheapest). 4% less than the ordinary cost of car insurance policy in The golden state. If you reside in Glendale, you'll need to pay an annual average of $2,283 for a comparable plan. That's 59. 8% greater than the state average and even more than dual Santa Maria's rate (affordable auto insurance).

cheap car affordable auto insurance insure insurance

cheap car affordable auto insurance insure insurance

Here are the ones frequently asked the solutions might aid you understand exactly how much cars and truck insurance coverage prices in California - affordable auto insurance. EXPAND ALLWhat is the typical price of cars and truck insurance coverage in The golden state?

It is for a 40-year-old motorist with a tidy driving document. We also utilized data from the following sources to finish the analysis:2019 information from the Federal Highway Administration to determine highway website traffic density2019 information from the Insurance coverage Research study Council to figure out data on without insurance motorists, The newest information from the united state

Some Of California Health Insurance, Medicare & More - Anthem Blue ...

Drivers in the Golden State pay approximately $2,065 per year, or regarding $172 per month, for full protection auto insurance coverage, according to Bankrate's 2021 survey of quoted annual costs. To determine the average price of automobile insurance policy in California, our insurance policy content group reviewed typical prices provided by Quadrant Info Services for metro areas across the state.

Chauffeurs in Los Angeles pay one of the most without a doubt for automobile insurance policy, according to our research study, with a typical rate for full insurance coverage insurance coverage of $2,838 each year, 37% above the state standard - prices. California parents including a 16-year-old driver to their full insurance coverage automobile insurance plan can anticipate an average annual increase of $3,744 annually.